Configuring Your General Settings in CommBilling

The General Settings section is the foundation of your CommBilling configuration. It ensures that your company information, tax validation, document numbering, and automation rules are correctly set up before you begin generating invoices or credit notes. Proper configuration in this section guarantees accuracy, compliance, and smooth daily operations.

You can manage all essential business information and automation preferences directly from this section.

Follow the steps below to configure your General Settings efficiently.

-

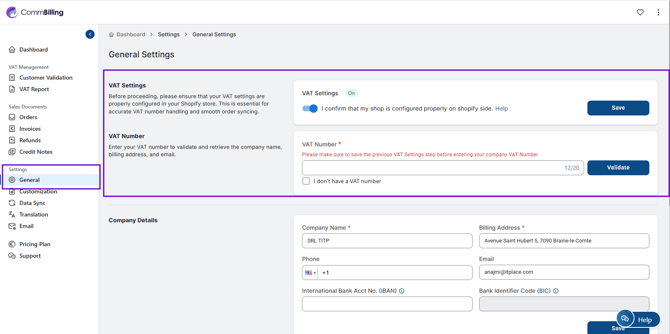

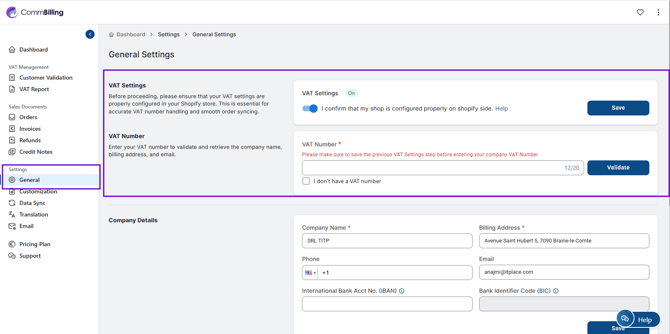

Step 1: On the left menu in the settings section, locate and select the General tab.

- Step 2: Go to the VAT Settings section and confirm that your Shopify store is configured properly for EU VAT.

Before enabling this option, make sure your Shopify VAT setup is complete. If you need assistance, refer to this article below.

Do This First: Set Up Your Shopify EU VAT Settings Before Using CommBilling

Once ready, activate the toggle and click Save.

-

Step 3 : Scroll to the VAT Number section and enter your company VAT Number.

This will validate your number and automatically retrieve your company name, billing address, and email.

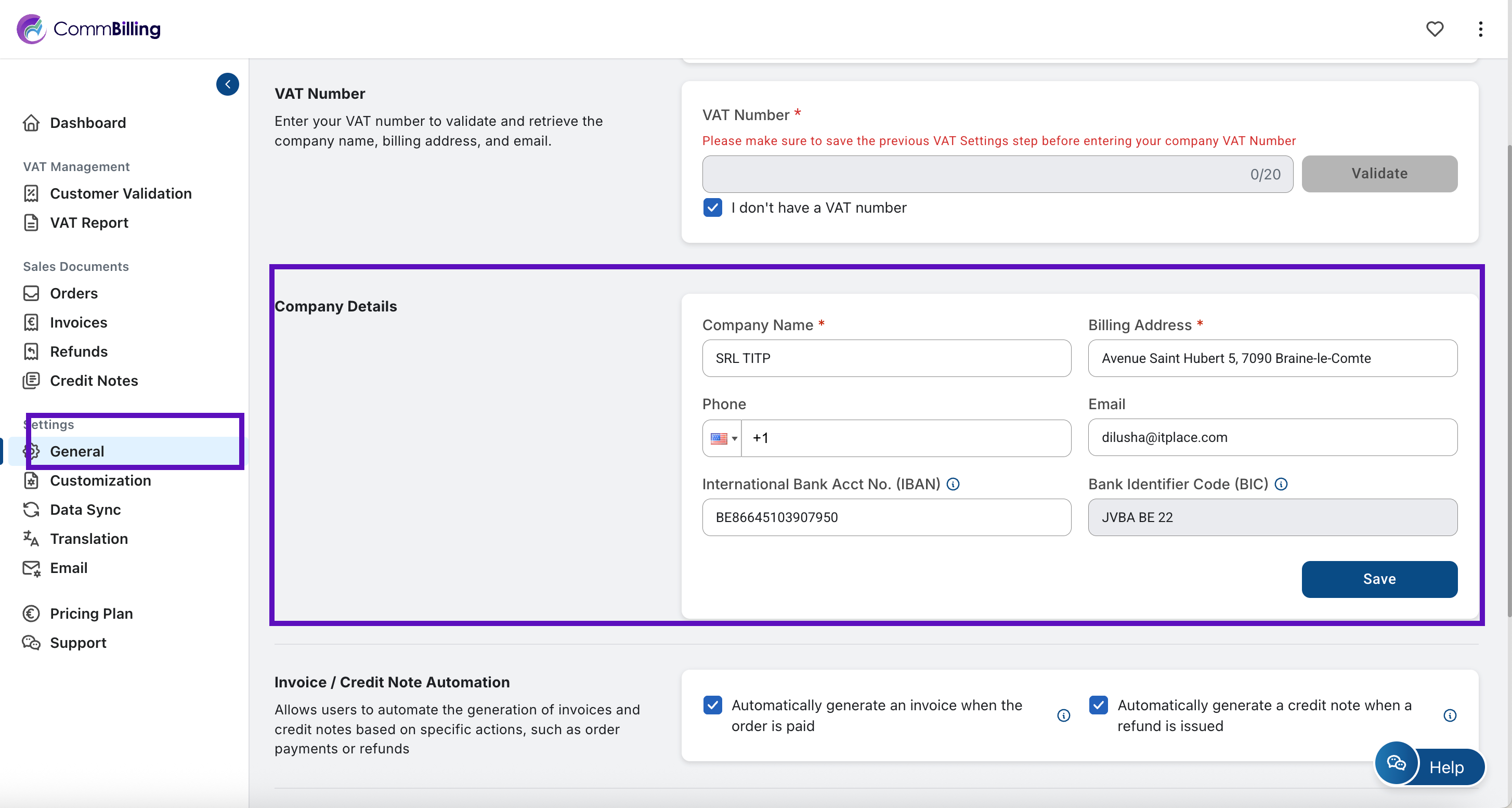

If you do not have a VAT number, select the box "I don't have a VAT number".

- Step 4 : Continue to the Company Details section and fill in all required fields such as company name, billing address, phone number, email, IBAN, and BIC.

These details will appear on your invoices and credit notes.

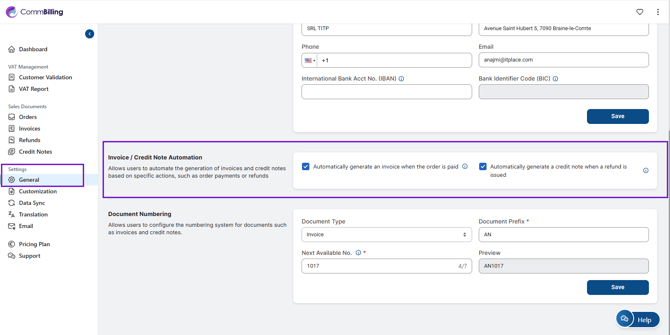

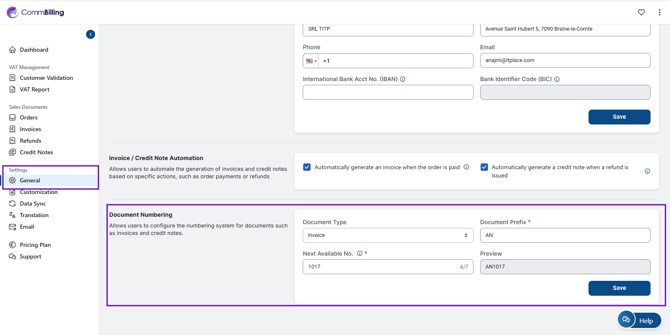

- Step 5: Go to the Invoice and Credit Note Automation section and activate or deactivate automation options according to your workflow needs.

You can choose whether invoices and credit notes should be generated automatically based on your internal processes.

=>Trigger "Automatically generate an invoice ": activate this feature means CommBilling will automatically generate invoices for each order.

=>Trigger "Automatically generate a Credit Note : Similarly, CommBilling will automatically generate credit notes for refunds or returns if this trigger is activated

- Step 6: Scroll to the Sales Document Numbering section and configure your preferred numbering sequence for invoices and credit notes.

This ensures consistency and proper document tracking.

Configuring your General Settings is an essential step toward ensuring compliance, accuracy, and operational efficiency. Once this setup is complete, CommBilling can correctly sync your orders, validate VAT information, and apply consistent details across all sales documents. This foundation ensures a smooth and professional billing experience from the start.