VAT Management Tab Explanation

The VAT Management Tab in CommBilling is an exclusive feature available only to users on the C-Business Plan. This tab serves as a comprehensive tool for managing customer VAT information and generating detailed VAT reports, helping you stay compliant with EU regulations.

The tab is divided into two key sections: Customer Validation and VAT Report, both offering powerful capabilities for efficient VAT management.

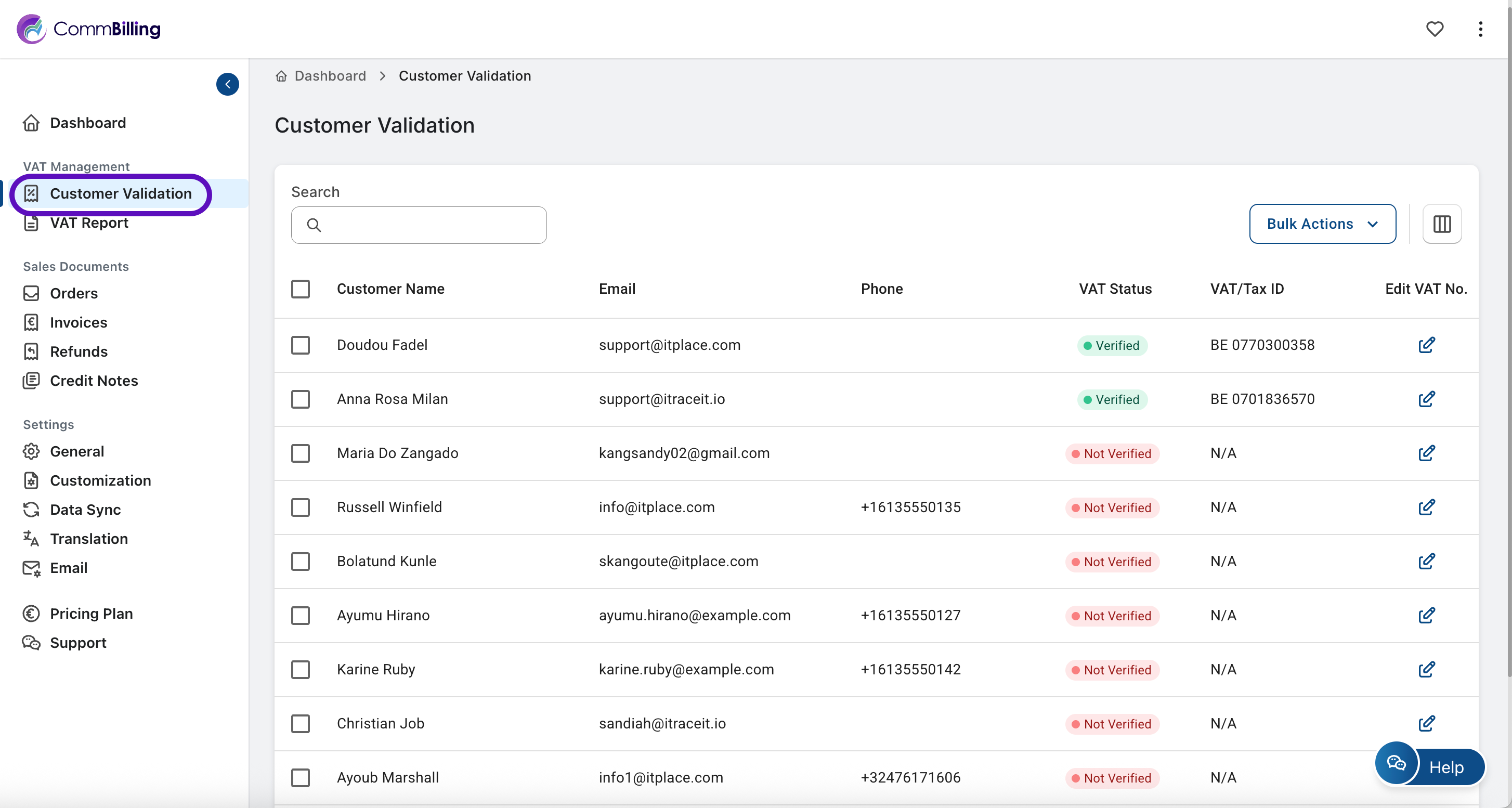

1. Customer Validation

In the Customer Validation section, you will have an organized view of all your customers, displaying important details like:

- Customer Name

- Email Address

- Phone Number

- VAT Status

- VAT/Tax ID

This section is designed to simplify the management of your customers’ VAT information. You can manually add or edit VAT details for each customer, and with a simple click, CommBilling will automatically verify the VAT number. The system will confirm whether the VAT number is valid, helping you ensure accuracy and compliance.

Additionally, you can see at a glance which VAT numbers have already been verified and which have not. This makes it easy to keep track of which customers need attention.

Bulk Actions:

- Export: Export the entire customer list, including VAT details, to a .CSV file for external use.

- Print: You can also print this view for offline reference or documentation.

These bulk actions allow you to efficiently manage VAT information across multiple customers at once, saving time and effort.

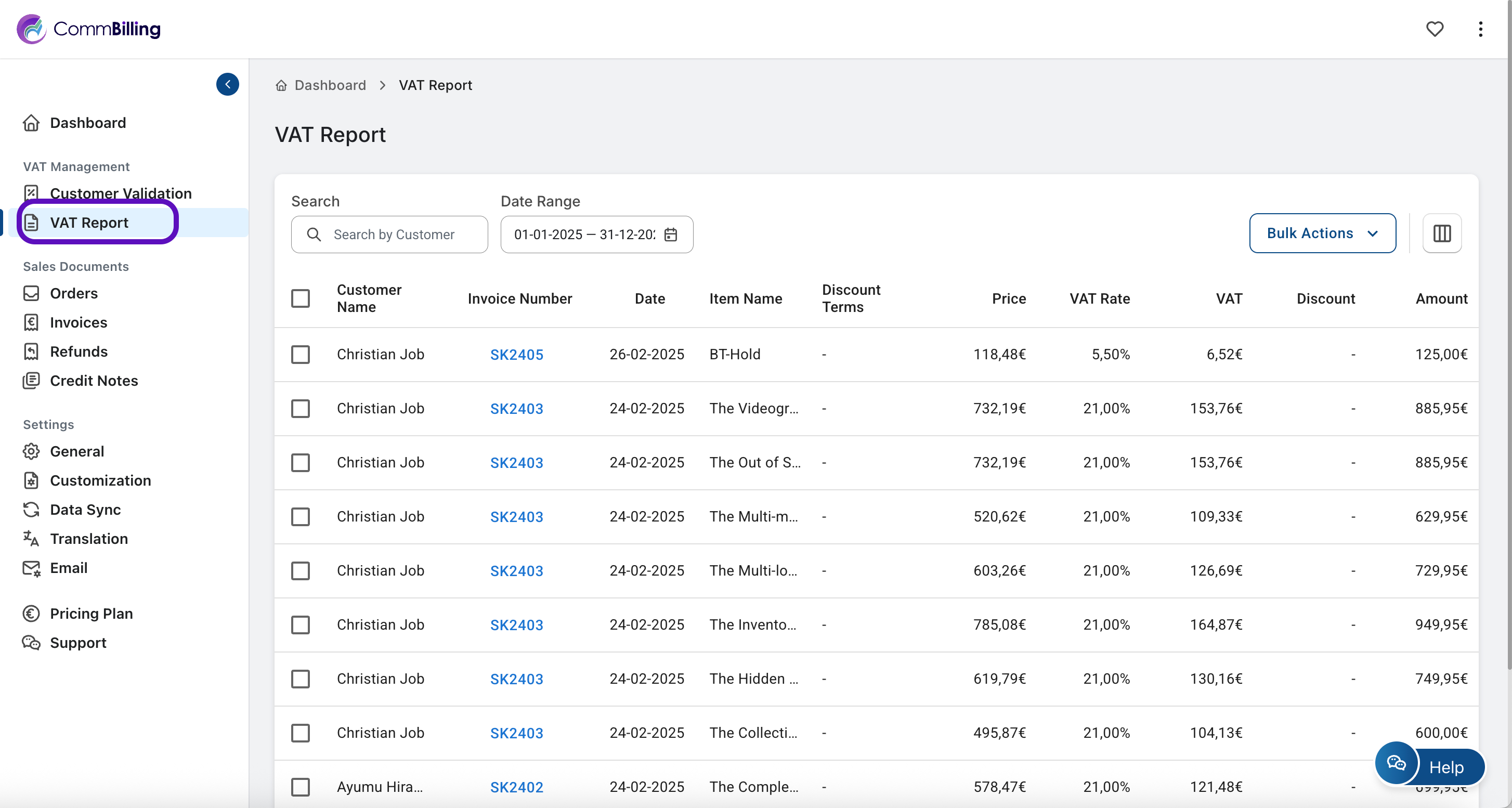

2. VAT Report

The VAT Report section offers a comprehensive breakdown of all VAT-related data, helping you analyze and track VAT across your sales. Here is what you can expect to see:

- Customer Name: The name of the customer associated with the VAT transaction.

- Invoice Number: The corresponding invoice number for each transaction.

- VAT Rate: The VAT rate that was used for the transaction.

- Country: The country associated with the VAT transaction.

- Amounts (Inclusive and Exclusive of VAT): A detailed view of the transaction amounts, showing both with and without VAT applied.

This section also allows you to filter results by a date range, enabling you to generate reports for specific time periods, whether it’s for monthly reviews or quarterly filings.

Bulk Actions:

- Export: Download the entire VAT report as a .CSV file, making it easy to integrate the data into your accounting software or provide it to your tax advisor.

- Print: Print the VAT report directly for documentation purposes or internal reviews.

By utilizing the VAT Management Tab, you can keep your customer VAT data accurate and up to date, and generate clear reports that give you a detailed breakdown of VAT transactions. The bulk actions make it easy to export and manage this data efficiently, ensuring smooth operations when it comes to VAT compliance.